UNDERSTANDING THE BANK OF CANADA’S OVERNIGHT LENDING RATE: WHAT IT IS AND WHY IT MATTERS

WHY THE OVERNIGHT LENDING RATE MATTERS

Interest rates have a significant impact on the financial lives of Canadians, affecting everything from mortgage payments to savings returns. At the heart of these rates is the Bank of Canada’s overnight lending rate - a key benchmark that has become increasingly relevant in everyday conversations. More than just a financial tool, the overnight rate plays a central role in managing economic stability, keeping inflation in check, and supporting long-term growth. Understanding how it works is essential for navigating today’s economy, particularly when it comes to making informed decisions about home financing.WHAT IS THE OVERNIGHT LENDING RATE?

The overnight lending rate, or key lending rate, is the interest rate at which major financial institutions lend and borrow funds from each other for one-day terms to manage liquidity. Set by the Bank of Canada as part of its monetary policy, this rate influences the prime rate used by commercial banks and affects borrowing costs on variable mortgages, lines of credit, and other loans.HOW THE OVERNIGHT LENDING RATE WORKS

The Bank of Canada doesn’t enforce a fixed rate but sets a target for the overnight rate within a 0.5% “operating band.” For example, with a 5.0% target, the band ranges from 4.75% to 5.25%.To keep the actual rate near the target, the Bank uses open market operations - buying or selling government securities to manage money supply and influence short-term lending between banks.

REAL-WORLD IMPACTS ON CONSUMERS

Though the overnight rate works behind the scenes, its impact on Canadians is significant.- Borrowing Costs: Changes to the overnight rate affect variable-rate mortgages and lines of credit, often leading to higher or lower monthly payments depending on whether rates rise or fall.

- Savings & Investments: Higher rates boost returns on savings accounts and GICs, while lower rates may drive investors toward riskier options.

- Housing Market: The real estate market is highly sensitive to rate changes. Higher rates increase borrowing costs, cooling demand and moderating price growth. Lower rates can spur demand and push prices up, especially where housing supply is limited.

LENDING RATES AND TARIFFS IN TODAY’S ECONOMY

The Bank of Canada’s overnight rate sits at 2.75% after a series of cuts that began in 2024. These reductions have made borrowing more affordable, especially for variable-rate mortgages and personal loans. However, with the future of monetary policy uncertain, borrowers may now face a period of stability rather than continued easing.In 2025, tariffs have become a growing economic concern. Renewed trade tensions - particularly between Canada and the U.S. - have led to new American tariffs on Canadian steel, aluminum, and energy. Canada has responded with retaliatory measures, increasing input costs for many businesses.As the year progresses, the Bank of Canada faces the challenge of balancing domestic economic needs with the risks posed by global trade developments, all while keeping inflation within its target range.HEALTHY SALES AND INVENTORY CAP OFF THE SUMMER SEASON

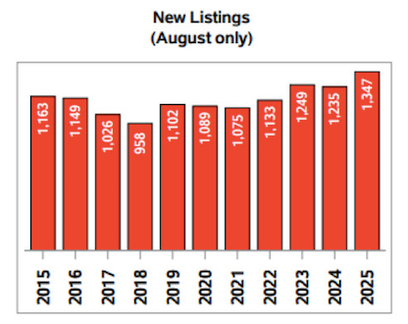

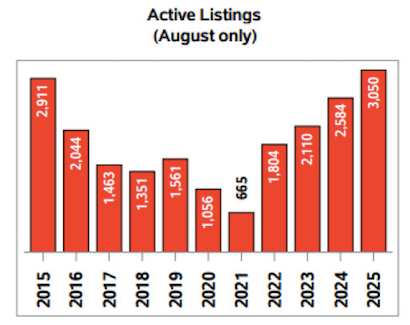

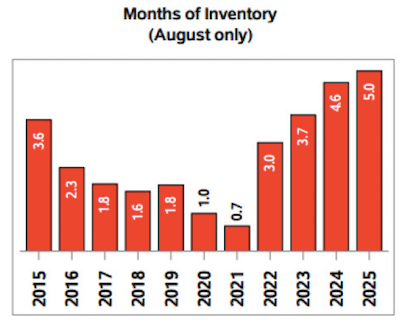

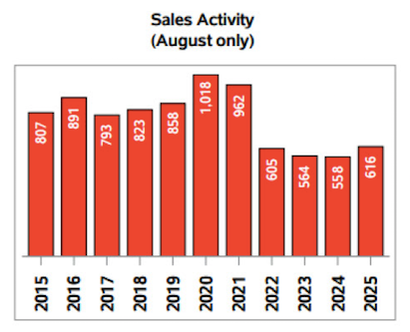

In August, 616 homes exchanged hands via the MLS® System of the London and St. Thomas Association of REALTORS® (LSTAR), up 10.4% compared to the same month a year ago. Similar to July, August posted its strongest sales month since 2021.“August recorded the highest inventory level in the last 10 years, with five months of inventory,” said Dale Marsh, 2025 LSTAR Chair.

AUTUMN has a way of gently nudging us to pause. It’s a season of transition - not rushed, but intentional. Whether it’s a change in routine, a fresh perspective, or simply the joy of pulling out your favourite sweater, autumn invites us to reflect and reset.

There’s comfort in the rituals: warm drinks, long walks, the scent of cinnamon and woodsmoke. And if you’re looking for a simple way to bring the season indoors, gather colourful leaves with the kids and make a leaf collage or garland. Just paper, glue, string and a little creativity turns a walk in the park into a memory on the wall. These small seasonal moments remind us that connection and creativity often live in the simplest acts.Greet Guests …with this charming alternative to a fall wreath.

There’s comfort in the rituals: warm drinks, long walks, the scent of cinnamon and woodsmoke. And if you’re looking for a simple way to bring the season indoors, gather colourful leaves with the kids and make a leaf collage or garland. Just paper, glue, string and a little creativity turns a walk in the park into a memory on the wall. These small seasonal moments remind us that connection and creativity often live in the simplest acts.Greet Guests …with this charming alternative to a fall wreath.Simply apply a layer of chalkboard paint to the inside of an old tray, then add autumn leaves and bittersweet berries for a seasonal finish.Source: https://tinyurl.com/3m8ad7v4

FRESH FRUIT CRUMBLE

Prep: 15 Mins. | Cook Time: 45 Mins. | Yield: 1

INGREDIENTS

Crumb Topping- 2 cups all-purpose flour

- 1 cup old-fashioned oats

- 1 cup packed brown sugar

- 1 tsp. finely grated lemon peel

- 3/4 tsp. apple pie spice

- 10 tbsp. butter, cut up

- Peaches, plums, mixed berries, apples, or pears

- Sugar

- Vanilla ice cream, for serving

- Whipped cream, for serving

INSTRUCTIONS

- Make the Crumb Topping: In mixer, mix flour, oats, brown sugar, lemon peel, apple pie spice, and 1/2 tsp. salt until combined. Add butter; beat until coarse crumbs form. With fingers, squeeze to form large chunks. Transfer to resealable plastic bag; freeze for up to 2 months.

- Prepare the Fresh Fruit Crumble: Toss chopped fruit (whatever’s in season) with a little sugar.

- Top with crumb topping.

- Bake at 375°F for 45 minutes or until fruit is soft and bubbly; serve with a scoop of vanilla ice cream or whipped cream.